Average time for creating an event

5 minutes

Number of organized events

14873

Rating given by our users

4.87/5

I'm ready to try

Yes, it's free !

0,29€ + 1%

Best price on the market

100% Français

100% Français

A responsive team listening to the organizers

732 improvements since 2014

Paiement en plusieurs fois

"Nous aimerions pouvoir proposer la possibilité de payer en plusieurs fois pour nos acheteurs"

demandé par Stéphane

8organisateurs intéréssés

Offre sur l'achat de plusieurs événements

"Il serait idéal de pouvoir inciter les acheteurs à cumuler plusieurs événemts dans leur panier en échange d'une réduction"

demandé par Hockey club mont blanc

21organisateurs intéréssés

Recevoir un bilan hebdomadaire

"Il serait génial de pouvoir envoyer un bilan hebdomadaire ou quotidien des ventes par e-mail"

demandé par Luc

8organisateurs intéréssés

Carte géographique des acheteurs

"Serait il possible d'afficher la provenance des acheteurs sur une carte dans l'écran des statistiques ?"

demandé par Oranges Mécaniques Team

5organisateurs intéréssés

Exclure certains tarifs des quotas

"Nous souhaiterions idéalement pouvoir exclure certaines tarifs des quotas afin de rendre les chiffres plus explicites"

demandé par Ciné Passion

5organisateurs intéréssés

Ajouter nos propres moyens de paiement

"Il serait super de pouvoir intégrer des moyens de paiements customisables afin d'avoir un meilleur suivi de nos encaissements"

demandé par La Cassine

12organisateurs intéréssés

E-mail auto avant l'événement

"Ayant un grand nombre de séances nous souhaiterions pouvoir envoyer automatiquement quelques heures avant le début de celle ci"

demandé par Isabelle

6organisateurs intéréssés

Ajouter des mots clés sur les événements

"Je souhaiterais pouvoir catégoriser mes événements et les filtrer via des mots clés"

demandé par Pascal

7organisateurs intéréssés

Accès dédié pour le comptable

"Pourrions nous donner un accès dédié et limité pour notre cabinet comptable ?"

demandé par Sara

4organisateurs intéréssés

Remboursement partiel

"Certains acheteurs souhaitent annuler leur participation et nous souhaitons les rembourser partiellement selon un calendrier"

demandé par Lucie

6organisateurs intéréssés

Afficher la liste des évènements passés

"Je veux pouvoir créer un agenda avec la liste des évènements passés de la même façon que je peux en faire un pour les évènements à venir afin de pouvoir les présenter sur mon site."

demandé par Jordan

13organisateurs intéréssés

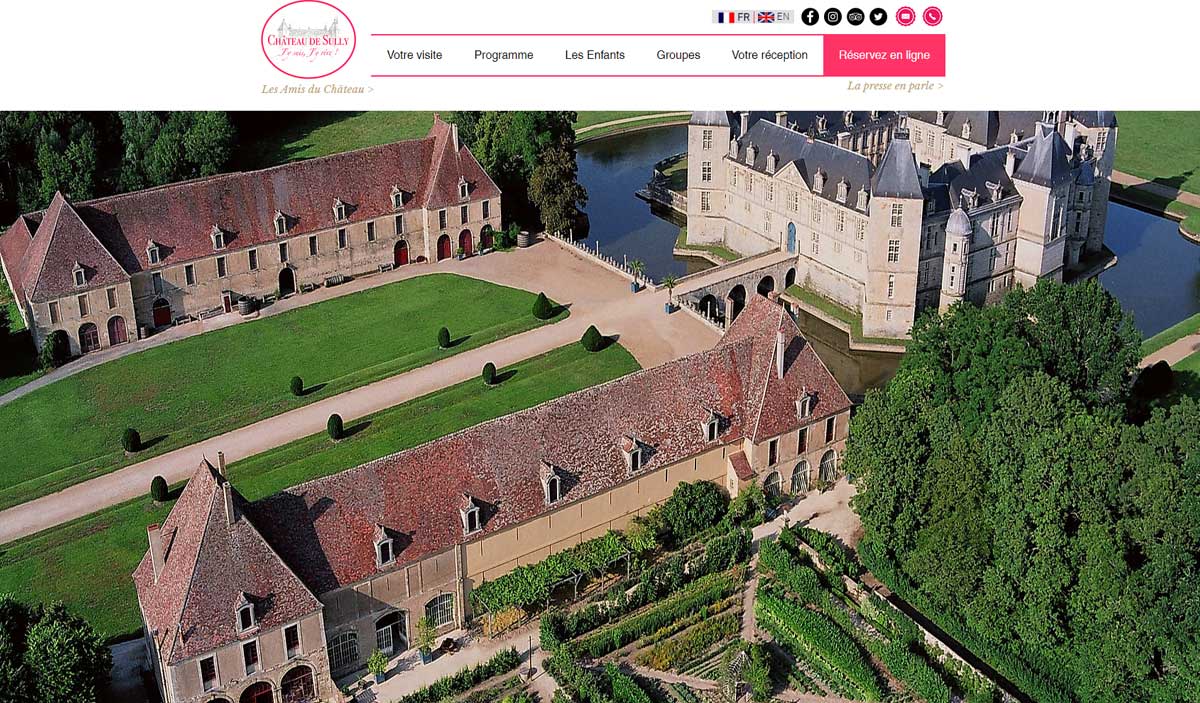

100% customizable

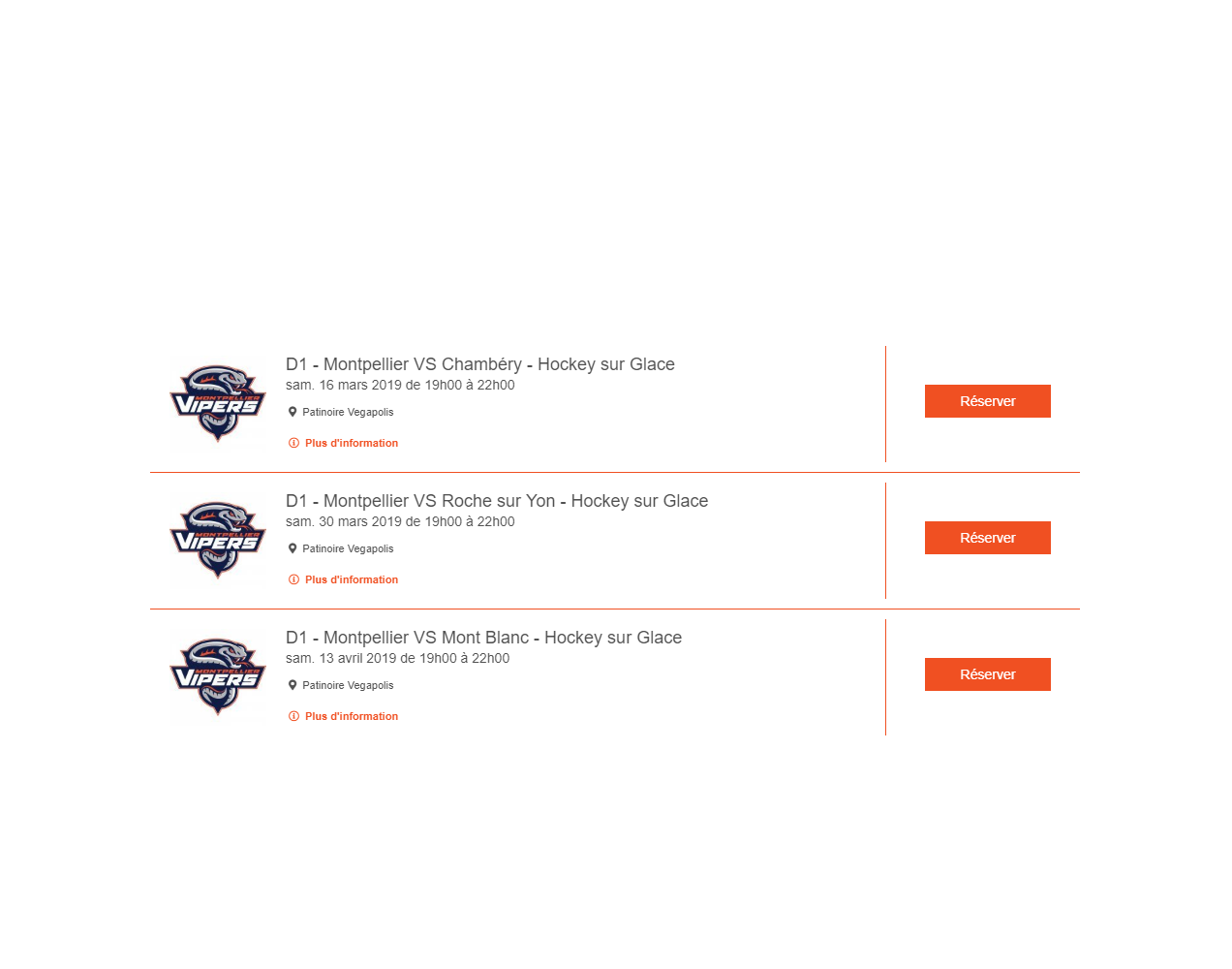

Sales Shop

Integration on your website

Tickets

Badges

... for free !

A GLOBAL solution

All the tools you need for today and tomorrow

Basket

Un système de panier intégré sur votre site ou sur votre agenda organisateur permettant de cumuler l'achat à plusieurs événements et la possibilité se mettre en avant des offres spéciales visant à maximiser le remplissage de vos événements

Access control

Flashez gratuitement vos billets via nos multiples méthodes de contrôle d'accès. Application smartphone, pc, liste ou terminaux professionels. Location de matériel possible ou achat à prix coûtant !

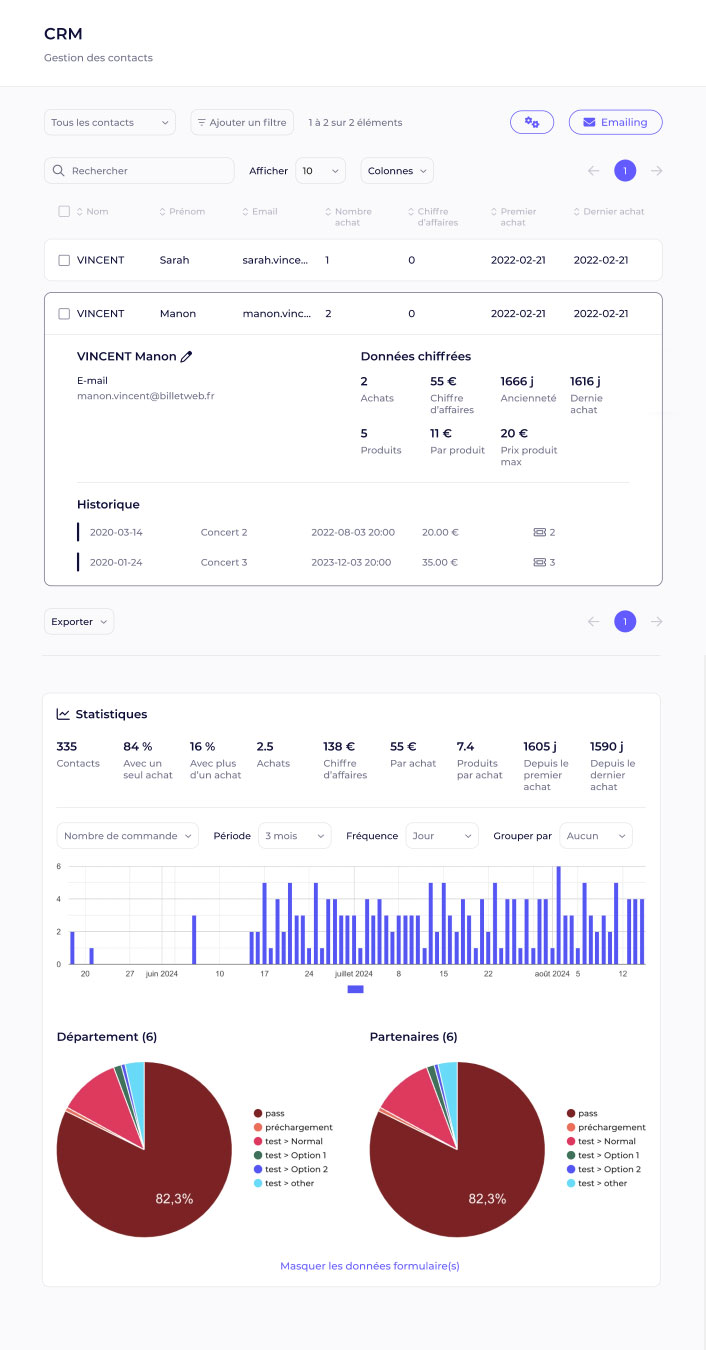

CRM

Votre relation avec le public est capitale ! Collectez et exploitez vos données acheteurs avec efficacité au travers de nos outils. Le CRM vous permettra d'apprendre à connaitre votre public et à le segmenter afin de mieux communiquer avec lui

Cashless

Simplifiez votre gestion des paiements sur site ! Grâce à notre technologie de pointe en cashless, vous augmentez vos revenus et sécurisez vos paiements pendant l'événement.

En savoir plus

En savoir plus

Sale on the spot

Une solution de vente sur place compatible avec pc et tablette. Utilisez une imprimante thermique, à ticket de caisse ou conventionelle. Location de matériel possible ou achat à prix coûtant. Et le meilleur pour la fin, c'est entierement gratuit !

+ de 10000 references

Un support réactif

Nous répondons vite et bien, 7j/7

4,8/5

Average rating given by our organizers

Gaelle

Apocalypse-z

Je tiens au vous remercier, car votre billetterie est vraiment très agréable et très pratique pour nous organisateurs, de plus vous êtes très réactif et c'est un plaisir de pouvoir travailler avec vous. Ayant essayé plusieurs billetteries auparavant vous êtes de loin la meilleure.

Thibaut Humbert

Table Ronde Francaise

Quelle réactivité du support !!! J'avais fait quelques erreurs de configuration dans BilletWeb et j'avais besoin d'une fonction supplémentaire pour me faciliter la tâche. Ni une, ni deux les erreurs de configurations ont été détectées et j'ai pu ainsi corriger le tir très rapidement. Pour la fonction supplémentaire, cela a été ajouté en moins d'une semaine. Moi je dis BRAVO !

Mathieu Isaia

Associé Fondateur - Fenixe

Des gens biens, compétents avec un beau produit et qui savent écouter leurs clients ça existe... Et c'est le cas chez @billetweb ! Merci

Guilhem

Région Auvergne-Rhône-Alpes

Simple et très ergonomique, Billetweb nous permet la gestion complète des étapes clés de nos événements. La richesse de fonctionnalités nous permet de répondre à tous les enjeux d'une grande institution publique : gestion modulaire par équipes thématiques, simplicité de modification d'inscriptions directement par les utilisateurs, personnalisation avancée des visuels en marque blanche.

Antoine

Organisateur des Talents de l'Est

Billetweb est un outil essentiel dans l'organisation de la finale régionale de notre concours de chant. Au delà d'un simple soutien, le site propose tout un panel de possibilité permettant la vente en ligne de places, la visibilité de l'événement, le contrôle des billets et l'ouverture de guichets. Je recommande vivement ce site.

Chrystel

Anpeip

Simple, intuitif, avec beaucoup de fonctionnalités .Un outil essentiel pour organiser une conférence et qui nous fait gagner un précieux temps!

Gaelle

Apocalypse-z

Je tiens au vous remercier, car votre billetterie est vraiment très agréable et très pratique pour nous organisateurs, de plus vous êtes très réactif et c'est un plaisir de pouvoir travailler avec vous. Ayant essayé plusieurs billetteries auparavant vous êtes de loin la meilleure.

Ludovic

Creative Events

J'ai trouvé la plateforme vraiment très puissante, avec de nombreuses options qui m'ont permis de vraiment gérer mon événement comme je l'entendais. Pour avoir comparé de nombreuses plateformes avant de choisir celle-ci, c'est vraiment celle qui me paraissait la plus complète et la moins chère. Je recommande bcp

Thibaut Humbert

Table Ronde Francaise

Quelle réactivité du support !!! J'avais fait quelques erreurs de configuration dans BilletWeb et j'avais besoin d'une fonction supplémentaire pour me faciliter la tâche. Ni une, ni deux les erreurs de configurations ont été détectées et j'ai pu ainsi corriger le tir très rapidement. Pour la fonction supplémentaire, cela a été ajouté en moins d'une semaine. Moi je dis BRAVO !

Les pompiers de vitrolles

Cela fait la troisième saison que l’on passe par votre site pour notre événement. Je tenais à féliciter votre plateforme car tout fonctionne parfaitement et de manière très simple. Nous avons dû cette année, annuler notre soirée pour raison sanitaire. La partie remboursements des pre-ventes nous inquiétait beaucoup. Grâce à votre plateforme cela s’est réalisé en quelques minutes. Vous êtes au top Merci pour votre travail.

Mathieu Isaia

Associé Fondateur - Fenixe

Des gens biens, compétents avec un beau produit et qui savent écouter leurs clients ça existe... Et c'est le cas chez @billetweb ! Merci

Stéphane

Art et jazz dans ma cour

l'application BilletWeb est parfaitement adaptée a l organisation d'un manifestation comme art et jazz qui a accueilli 6000 festivaliers sur 2 jours. aucun bug, une source d'information très interessante pour analyser les données géographiques, d'âge de nos visiteurs, la mise en main est très simple. les frais de locations réduits nous ont incités a recommander les réservations en ligne. nous recommandons et reprendrons billetweb pour nos futurs manifestations.

Guilhem

Région Auvergne-Rhône-Alpes

Simple et très ergonomique, Billetweb nous permet la gestion complète des étapes clés de nos événements. La richesse de fonctionnalités nous permet de répondre à tous les enjeux d'une grande institution publique : gestion modulaire par équipes thématiques, simplicité de modification d'inscriptions directement par les utilisateurs, personnalisation avancée des visuels en marque blanche.

Imep

Paris College of Musi

Nous sommes un tout petit organisateur de spectacles et Billetweb nous permet de gérer une billetterie en ligne pratique, simple d'utilisation, très complète et... pas chère. C'est le service qu'il nous fallait

Antoine

Organisateur des Talents de l'Est

Billetweb est un outil essentiel dans l'organisation de la finale régionale de notre concours de chant. Au delà d'un simple soutien, le site propose tout un panel de possibilité permettant la vente en ligne de places, la visibilité de l'événement, le contrôle des billets et l'ouverture de guichets. Je recommande vivement ce site.

Aymeric

GDG Nantes

Billetterie très pratique, avec de nombreuses fonctionnalitées permettant de gérer facilement la vente de billets de notre événement ainsi qu'une équipe dev très à l'écoute et réactive sur nos besoins. Parfait !

Chrystel

Anpeip

Simple, intuitif, avec beaucoup de fonctionnalités .Un outil essentiel pour organiser une conférence et qui nous fait gagner un précieux temps!

Nicola

Baila Salsa

Je suis très satisfait de billet web. C’est très simple d’utilisation et les tarifs très compétitifs. Cette année nous avons fait presque 50% des inscriptions de notre association grace à billet web ce qui nous simplifie grandement l'administratif :) Un grand merci !

Cédric

Mlle Violette

Service client très rapide et adaptable ! Tarifs très compétitifs et solution facile à prendre en main et complète

APIRAF

Catherine GARCIA

Simple, efficace, plein de fonctionnalités qui facilitent l'organisation d'une soirée au niveau du paiement, au niveau entrées, pour avoir le nombre de participants en temps réel et par anticipation. Permet aussi un contrôle facile aux entrées (scan des billets), permet aussi de compléter la vente en guichet. Site convivial. Permet aussi le remboursement d'une entrée. Edite des billets, permet d'effectuer des statistiques. Site très bien pensé. Permet aussi de gérer les cotisations annuelles d'adhérents.

Centre Chorégraphique Marina Torres

L'utilisation de Billetweb est intuitive. Vous pouvez créer une véritable billetterie professionnelle sans aucune notion de programmation et seulement en quelques clics. Et si vous rencontrez des difficultés, des techniciens compétents sont là pour vous aider.Je recommande vivement !!!

Ludovic

Creative Events

J'ai trouvé la plateforme vraiment très puissante, avec de nombreuses options qui m'ont permis de vraiment gérer mon événement comme je l'entendais. Pour avoir comparé de nombreuses plateformes avant de choisir celle-ci, c'est vraiment celle qui me paraissait la plus complète et la moins chère. Je recommande bcp

Les pompiers de vitrolles

Cela fait la troisième saison que l’on passe par votre site pour notre événement. Je tenais à féliciter votre plateforme car tout fonctionne parfaitement et de manière très simple. Nous avons dû cette année, annuler notre soirée pour raison sanitaire. La partie remboursements des pre-ventes nous inquiétait beaucoup. Grâce à votre plateforme cela s’est réalisé en quelques minutes. Vous êtes au top Merci pour votre travail.

Stéphane

Art et jazz dans ma cour

l'application BilletWeb est parfaitement adaptée a l organisation d'un manifestation comme art et jazz qui a accueilli 6000 festivaliers sur 2 jours. aucun bug, une source d'information très interessante pour analyser les données géographiques, d'âge de nos visiteurs, la mise en main est très simple. les frais de locations réduits nous ont incités a recommander les réservations en ligne. nous recommandons et reprendrons billetweb pour nos futurs manifestations.

Imep

Paris College of Musi

Nous sommes un tout petit organisateur de spectacles et Billetweb nous permet de gérer une billetterie en ligne pratique, simple d'utilisation, très complète et... pas chère. C'est le service qu'il nous fallait

Aymeric

GDG Nantes

Billetterie très pratique, avec de nombreuses fonctionnalitées permettant de gérer facilement la vente de billets de notre événement ainsi qu'une équipe dev très à l'écoute et réactive sur nos besoins. Parfait !